Fintech UX UI Design is shaping how people experience money in 2026. As digitalization of banking accelerates worldwide, users now expect fast, simple, and highly personal banking services. Because financial products are becoming more complex, design must do more work; guiding users clearly, building trust, and reducing friction. At Graphymania, we see AI-driven and personalized interfaces not as buzzwords, but as practical tools that improve everyday financial decisions.

Meanwhile, institutions influenced by global standards from the World Bank are pushing digital-first banking services. As a result, fintech products must feel human, transparent, and easy to use, no matter how advanced the technology behind them is.

AI-Powered Personalization Becomes the New Standard

AI is no longer hidden in the background. In 2026, it actively shapes Fintech UX UI Design by adapting interfaces to each user. However, the goal is not complexity; it is clarity.

How personalization shows up in fintech interfaces

Smart dashboards that adjust based on spending habits

Personalized insights instead of generic alerts

Context-aware suggestions during key actions, like payments

For example, a banking app may highlight savings tips right after a salary credit. Because the experience feels timely and relevant, users trust the platform more. In addition, this level of personalization supports modern banking services that focus on long-term relationships, not just transactions.

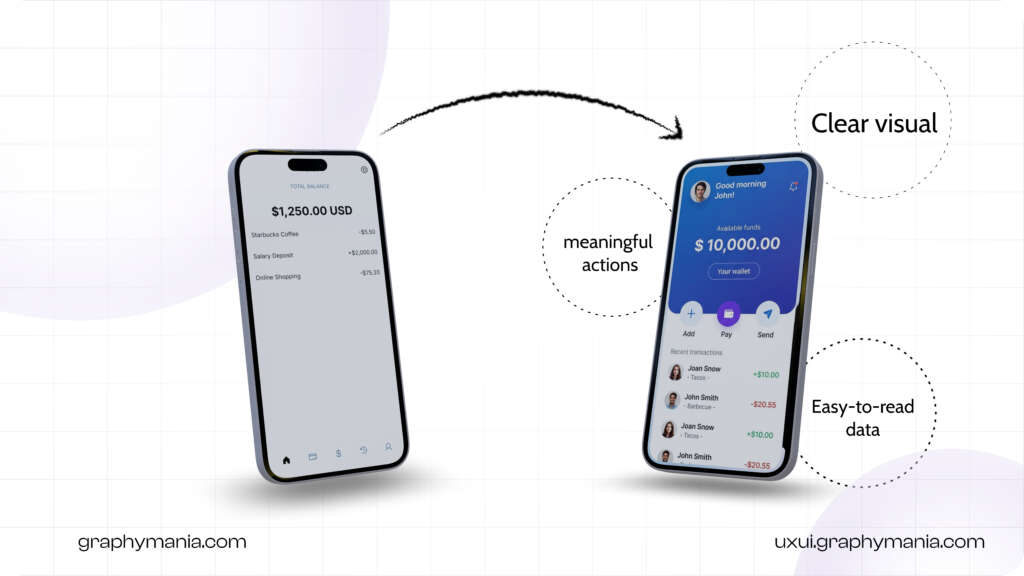

Simpler Interfaces for Smarter Digital Banking

As digitalization in banking expands, fintech products serve users with different levels of financial knowledge. Therefore, simplicity becomes essential.

Instead of overwhelming dashboards, 2026 design trends focus on:

Clear visual hierarchy

Fewer but more meaningful actions

Easy-to-read data summaries

This approach aligns with the idea of a modern bank of service, where usability matters as much as functionality. Meanwhile, clean layouts help reduce errors and improve confidence, especially for first-time users.

Why simplicity works:

Users complete tasks faster

Cognitive load is reduced

Financial decisions feel less stressful

As a result, Fintech UX UI Design becomes more inclusive and scalable across regions.

Conversational UX That Feels Natural

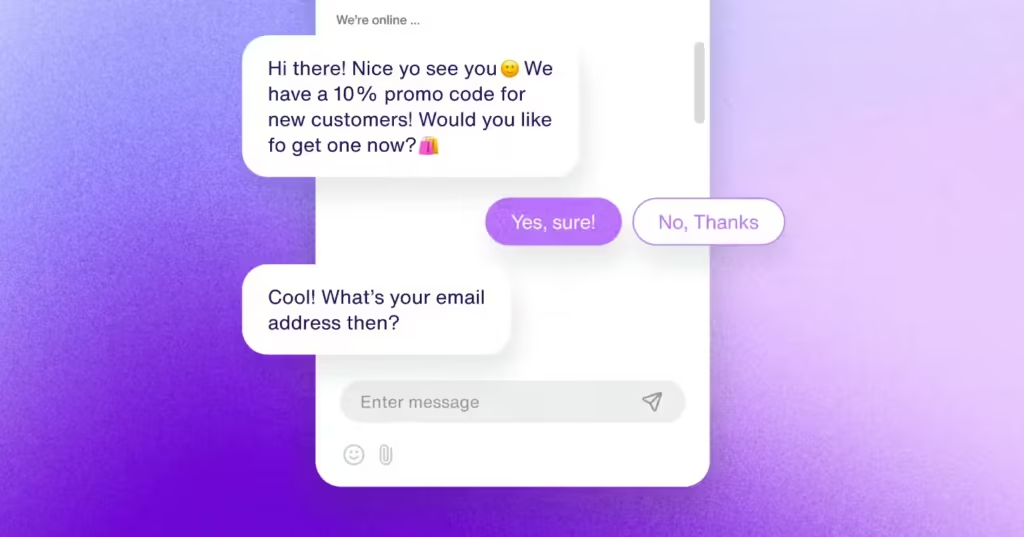

Chat-based interfaces are evolving, but in 2026, they feel more natural and supportive. Instead of robotic replies, fintech apps now use conversational UX to guide users step by step.

However, good conversational design is not about talking more; it is about helping better.

Common use cases

Explaining transactions in simple language

Guiding users through loan or KYC processes

Answering quick balance or payment questions

Because users already chat daily on other platforms, this feels familiar. Therefore, conversational UX strengthens trust in banking services while reducing support costs.

Trust-Centered Design and Ethical AI

Trust remains the backbone of Fintech UX UI Design. In 2025, users want to know why something is suggested, not just what is suggested.

Design trends now emphasize:

Clear explanations for AI-driven insights

Visible security indicators without fear tactics

Transparent data usage messaging

This approach reflects global best practices promoted by institutions like the World Bank, where user protection and clarity are essential. As a result, fintech brands that design for trust stand out in a crowded market.

Key trust signals in UI

Simple language privacy notices

Step-by-step confirmation flows

Human-friendly error messages

Unified Experiences Across Banking Touchpoints

Users move between apps, websites, and dashboards daily. Therefore, Fintech UX UI Design in 2026 focuses on consistency across all touchpoints.

A unified design system ensures:

Familiar interactions across platforms

Faster onboarding

Stronger brand recognition

This is especially important for digitalization banking initiatives, where services scale rapidly. Meanwhile, consistent design supports the idea of a seamless bank of service rather than a disconnected tools.

Conclusion: Designing the Future of Finance with Purpose

In conclusion, Fintech UX UI Design in 2026 is defined by AI-driven personalization, simplicity, trust, and consistency. These trends are not about technology alone, but about creating meaningful banking services that fit naturally into users’ lives. As digitalization in banking continues to grow under global influence from organizations like the World Bank, design will play a critical role in shaping how people interact with a modern bank of service.

"Design is the bridge between advanced fintech technology and everyday banking services."

FAQs

1. What is Fintech UX UI Design?

Fintech UX UI Design focuses on creating intuitive, secure, and user-friendly digital experiences for financial products such as banking apps, payment platforms, and investment tools. It ensures users can access banking services easily while feeling confident and informed at every step.

2. Why is Fintech UX UI Design important in 2026?

In 2026, digitalization banking is accelerating globally. As more users rely on digital banking services, well-designed UX UI becomes critical for trust, usability, and retention. Poor design can confuse, while thoughtful design improves adoption and long-term engagement.

3. How is AI influencing Fintech UX UI Design trends?

AI enables personalization in Fintech UX UI Design by adapting interfaces to user behavior. For example, dashboards adjust based on spending patterns, and insights appear at the right time. However, modern fintech design focuses on explainable AI so users understand why recommendations are shown.

4. What role does personalization play in modern banking services?

Personalization helps banking services feel more relevant and human. Instead of generic alerts, users receive tailored insights based on their activity. As a result, fintech products feel less transactional and more supportive, improving trust and usability.

5. How does digitalization banking impact UX UI decisions?

Digitalization banking increases the diversity of users across regions and financial literacy levels. Therefore, Fintech UX UI Design prioritizes simplicity, clarity, and consistency so users can complete tasks quickly without confusion or stress.

6. What is trust-centered design in fintech products?

Trust-centered design ensures transparency, security, and clarity across fintech interfaces. It includes clear data usage explanations, visible security cues, and friendly error messages. This approach aligns with global standards promoted by institutions like the World Bank to protect users in digital financial ecosystems.

7. How does UX UI design support a modern bank of service model?

A bank of service model relies on seamless, connected experiences across apps and platforms. Fintech UX UI Design ensures consistency, familiar interactions, and smooth transitions so users experience the bank as one unified service rather than fragmented tools.

8. What are common UX UI mistakes fintech companies should avoid?

Common mistakes include:

Overloading dashboards with too much data

Using technical language, users don’t understand

Hiding security or privacy information

Inconsistent design across platforms

Avoiding these issues improves usability and trust in banking services.

9. How does good UX UI design improve fintech user retention?

Clear flows, personalized insights, and transparent interactions reduce friction. As a result, users complete tasks faster and feel more confident, which directly improves retention and engagement with fintech platforms.

10. How can fintech companies prepare their UX UI for future trends?

Fintech companies should invest in scalable design systems, ethical AI usage, and user-first personalization. By focusing on clarity, trust, and adaptability, Fintech UX UI Design can evolve alongside digitalization banking and changing user expectations.

Still here?

At Graphymania, we believe great fintech design balances innovation with empathy. Because when users feel understood, they stay engaged—and that is the true success of fintech UX.