Fintech Product Design plays a critical role in shaping how users perceive trust in digital financial services. Money is personal, so users form opinions fast. If an interface feels confusing or unreliable, trust breaks instantly. However, when UX UI design feels calm, transparent, and predictable, trust develops naturally.

Across the financial market, leading fintech brands are proving that good design is not decoration—it is reassurance. Let’s explore how real fintech products build trust through UX UI design.

Why Trust Is the Foundation of Fintech Product Design

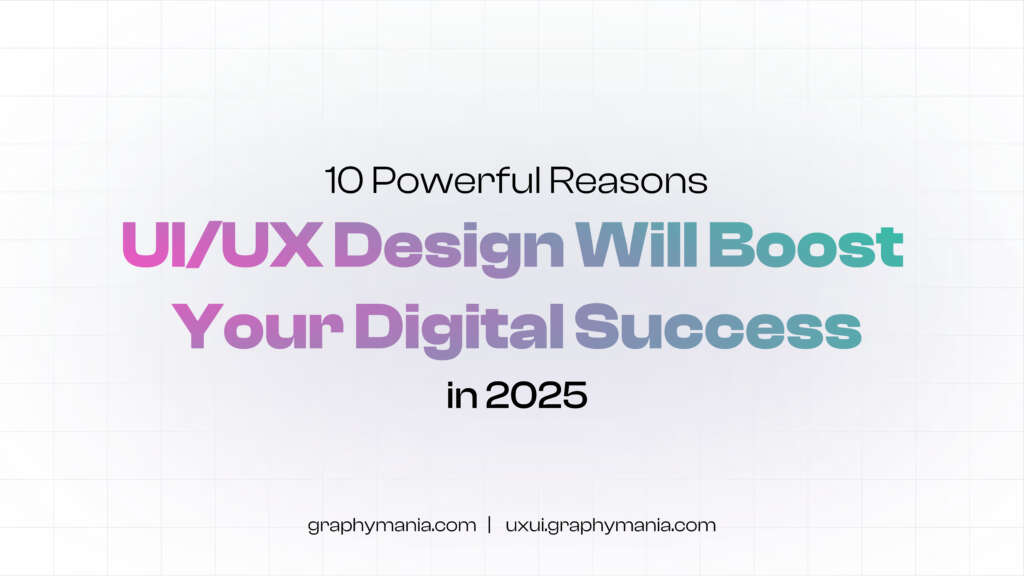

Trust is created through repeated, reliable experiences. For example, Revolut builds trust by clearly showing transaction status in real time. When users send money, they see instant confirmations, timestamps, and recipient details. As a result, users feel confident that nothing is hidden.

Similarly, Paytm reduces user hesitation by breaking complex actions—like bill payments or UPI transfers—into clear, guided steps. Because users always know what comes next, errors feel less risky.

Key trust-building patterns used by real fintech apps:

Instant confirmations after every action

Clear transaction histories with visual hierarchy

Simple, human language instead of banking jargon

UX UI Design That Makes Security Feel Visible

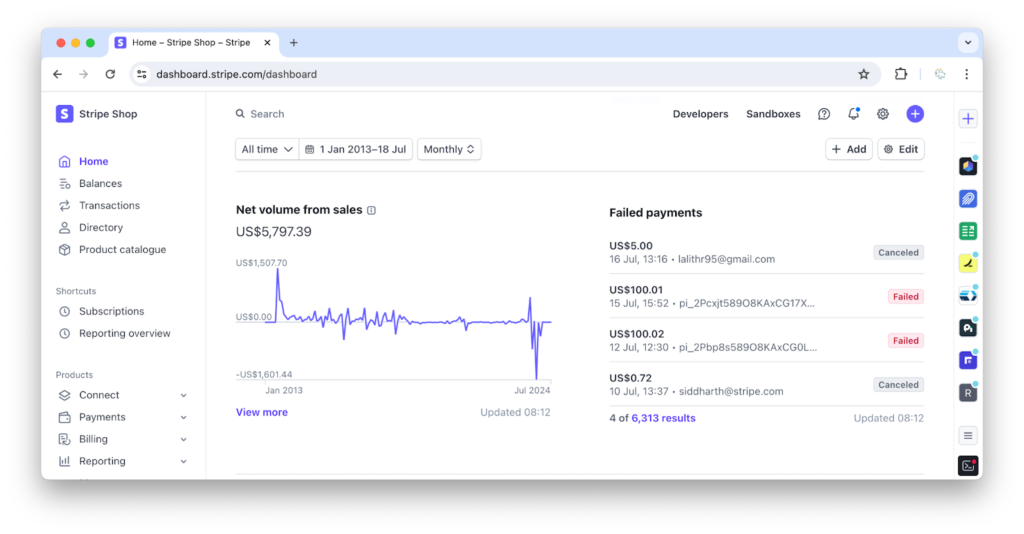

While most users don’t understand backend security, they trust what they can see. Stripe is a strong example. Its dashboards use clean layouts, predictable spacing, and clear error messages. Therefore, even failed payments feel controlled and understandable.

Another example is Google Pay, which reassures users with visual cues like biometric icons, subtle animations, and short confirmation messages. These signals quietly communicate safety without overwhelming the user.

Security-focused UX patterns in real products include:

Biometric icons during authentication

Step-by-step payment verification

Clear explanations when something fails

Mobile Banking UX That Users Rely On Daily

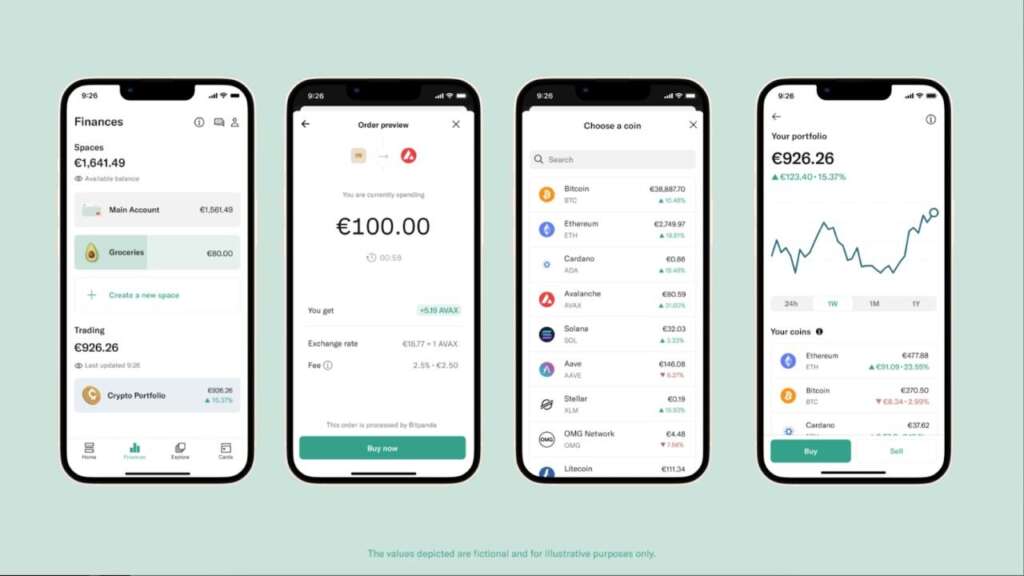

In mobile banking, trust is tested daily. Monzo excels by showing spending insights immediately after a transaction. Users don’t wonder where their money went; they see it instantly.

Likewise, N26 builds trust by showing banking rates, fees, and exchange costs upfront. Because there are no surprises, users feel respected.

Effective mobile UX patterns seen in real apps:

Real-time balance updates

Clear visibility of fees and rates

One-tap access to support

Reducing Cognitive Load: Lessons from Real Fintech Interfaces

Complex financial decisions create stress. Robinhood simplifies investing by using visual cues, progress flows, and plain language. Although finance is complex, the interface feels approachable.

Similarly, Wise explains fees visually before a transfer. Because users see where every rupee goes, trust increases, even during international transactions.

Real-world cognitive load reduction techniques:

Visual summaries instead of long text

Progressive disclosure of information

Simple graphs for financial data

Transparency in the Financial Market: What Top Fintechs Get Right

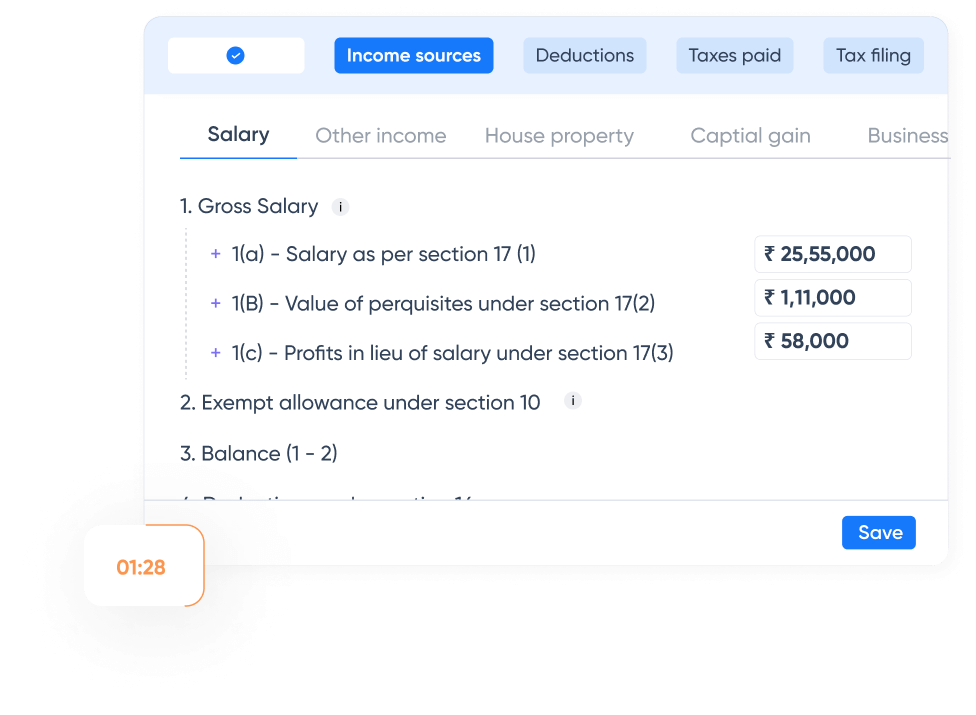

In today’s financial market, transparency has a direct impact on retention. ClearTax earns trust by clearly explaining calculations, step by step. Users understand outcomes before committing.

Meanwhile, LendingClub highlights interest rates, repayment timelines, and fees early in the flow. Therefore, users don’t feel misled later.

Transparency-focused UX elements include:

Fee breakdown screens

Rate comparison visuals

Pre-confirmation summaries

How Graphymania Applies These Real-World Lessons

At Graphymania, we study real fintech behavior, not assumptions. Our Fintech Product Design approach combines proven UX patterns with brand-specific needs.

We design experiences that:

Learn from successful fintech examples

Reduce uncertainty at every step

Balance simplicity with depth

Build trust gradually through consistency

Because trust is earned through use, our UX UI design focuses on long-term confidence, not just first impressions.

Conclusion: Fintech Product Design That Users Trust

In conclusion, Fintech Product Design is central to building trust in modern financial services. Real-world fintech examples show that clarity, transparency, and thoughtful UX UI design directly influence user confidence.

As the financial market grows more competitive, products that feel honest and easy to use will win. Trust is not added at the end; it is designed from the first screen.

"In fintech, trust is earned through every interaction. UX UI design makes that trust visible"

FAQs

1. What is Fintech Product Design?

Fintech Product Design focuses on creating digital financial products that are easy to use, secure, and trustworthy through effective UX UI design.

2. Why is UX UI design important in financial services?

UX UI design builds trust by making financial actions clear, predictable, and transparent, which reduces user anxiety and errors.

3. How does UX UI design improve mobile banking experiences?

Good mobile banking UX UI design ensures real-time updates, simple navigation, and clear visibility of banking rates and transactions.

4. How does transparency in design build trust in the financial market?

Transparent UX UI design clearly explains fees, policies, and rates, helping users make informed decisions without confusion.

5. What role does Graphymania play in fintech UX UI design?

Graphymania designs trust-first fintech experiences by combining user psychology, clarity-driven UX, and scalable product design systems.

Still here?

Great. Share your goals, and Graphymania will help you design, test, and ship elegant interfaces with the Glass Effect — fast and on brand.